Why You Should Buy 'Cancel for Any Reason' Insurance for Your Cruise

Table Of Content

That's why it always pays to read the fine print in a travel insurance policy before you purchase it to know what you're getting in advance. Alternatively, apply for a credit card that offers trip interruption insurance as a perk. Cruise-line insurance usually offers secondary coverage (see below) and is more limited than similarly priced coverage you can buy on your own. (For example, cruise-line coverage generally doesn't cover its own financial default.) Third-party travel insurance companies offer more inclusive policies that provide more protection, and these are often the best bet. As the phrase suggests, you can cancel your trip for any reason (such as concern over traveling to a particular area due to political unrest or disease outbreaks) -- a luxury normal insurance policies won't allow.

Our Trusted Providers Include

This way you can select a plan that is cost-effective yet provides the most value. If you don't have a credit card with coverage or you want to add more protection, it is wise to buy insurance as soon as possible after booking the cruise. Some companies require that you buy cruise insurance within two weeks of making the initial deposit, particularly if you're hoping for pre-existing medical coverage. Cruise travel insurance plans are designed to cover you on your water-bound vacations whether you’re traveling across the sea or on a river cruise. From the Bahamas to Barcelona, there is a Travel Guard plan to cover your cruise vacation no matter how long or short it may be. With cruise insurance, you’re covered for unexpected issues that can interfere with your travel plans.

Policy to Cover a 7-Night $1,599 Mediterranean Cruise.

The Seven Corners Trip Protection Elite plan has generous coverage limits for evacuation and repatriation and accident and sickness. Seven Corners Travel Insurance plans also cover Covid-related illnesses. This plan includes $35,000 in rental car damage coverage (where it's valid) due to collision, theft or a natural disaster.

Pricing and Terms of CFAR Insurance

Here are the 5 best cruise insurance plans - CNBC

Here are the 5 best cruise insurance plans.

Posted: Tue, 17 Oct 2023 12:31:20 GMT [source]

This can be important for adventurous cruisers who plan to take part in activities like jet skiing, scuba diving, or parasailing during their cruise. World Nomads Travel Insurance has been a top choice for comprehensive travel insurance for many years now. You can add travel insurance to your cruise when you book with the cruise line or a travel agent. Alternatively, you can purchase travel insurance directly from travel insurance agencies.

With 150% for trip interruption, primary emergency medical and a $50 deductible for care, the GoReady plan offers comprehensive coverage for nearly any situation. Most cruise companies will offer a single travel insurance policy choice to their customers. Many cruisers find that these plans can be more expensive and offer less coverage than plans that we offer, which is why comparing your options makes a lot of sense if you are going on a cruise. This plan's coverage includes an impressive $1 million per person for medical evacuation and a high $2,500 coverage limit for bag loss. You have extra time – 21 days – from your initial deposit to add a cancel-for-any-reason upgrade to your plan.

Age of Traveler

Cruise insurance can pay for you to rejoin the cruise if you can’t board on time because of an issue covered by the policy, such as severe weather. Cruise insurance is worth considering if you can’t afford to lose the money you paid in advance for nonrefundable trip costs if you have to cancel your cruise. If your vacation costs $10,000, the trip interruption insurance will cost between $500 and $1,000. When it comes to buying travel insurance, don't worry if you've paid for your cruise but haven't yet purchased your airline tickets. You can estimate the airfare cost when buying your travel insurance and then give your provider your exact travel itinerary once those tickets are booked.

Understanding Trip Interruption Insurance

Best COVID-19 Travel Insurance Plans - April 2024 - Los Angeles Times

Best COVID-19 Travel Insurance Plans - April 2024.

Posted: Tue, 16 Apr 2024 07:00:00 GMT [source]

Yes, if you become sick or a pre-existing condition suddenly worsens or becomes acute during your vacation, the plan provides reimbursement for eligible medical expenses for any illness, including COVID-19. Here’s a breakdown of the different insurance companies and why they stood out among the best. Note that these plans offer 75% of your total costs back if you cancel your trip. Nonetheless, it offers an inexpensive way to eliminate a serious risk of financial hardship or ruin.

Whether it's a sudden illness, adverse weather, or other unexpected occurrences, having the right insurance can make a world of difference. “If a comprehensive plan isn’t in the budget, buying a trip cancellation policy is better than not buying a policy at all,” says Brooklyn. You'll need to review the policy before the trip to decide if you need to purchase additional coverage. Additionally, you shouldn’t expect your U.S.-based health insurance plan to cover you on your cruise, especially if you’re on an international cruise. And it’s exceptionally expensive if you need to be evacuated for a medical condition. If you're injured or become severely ill during a cruise, especially in a foreign country, it may be difficult to access help without the assistance of trained professionals that comes with many insurance plans.

Travel Insurance

One consideration though, if you are contemplating such a change, your new coverage dates would mean you won't be covered for any nonrefundable fees (like airline change fees). As with any travel insurance purchase, it is wise to do the math, comparing the increased premium of the CFAR add-on, coupled with the anticipated payout of only a portion of your upfront costs if you need to cancel. Whether it makes sense to purchase the insurance or chance losing trip payments may boil down to your tolerance for risk and/or the cost of your cruise.

If a winter storm causes you to miss your flight to where the ship is boarding, "travel insurance could help you get to the next port to join the cruise, so you don't miss your entire trip," Page said. Cruising is a great way to explore multiple destinations in one trip. While certain Medicare Supplement Plans do have some foreign emergency medical benefits, not all do.

Also, in some cases, the cruise line may only return you to your original port of departure, which then may necessitate additional transportation from there to your home. As an example, when Carnival Triumph had mechanical problems that required it to be towed to New Orleans, most passengers were bussed back to the originating port of Galveston. Those with travel insurance could have flown directly from New Orleans to their home airport in most cases. Other benefits and services provided with the Platinum Plan are effective once you depart on your trip.

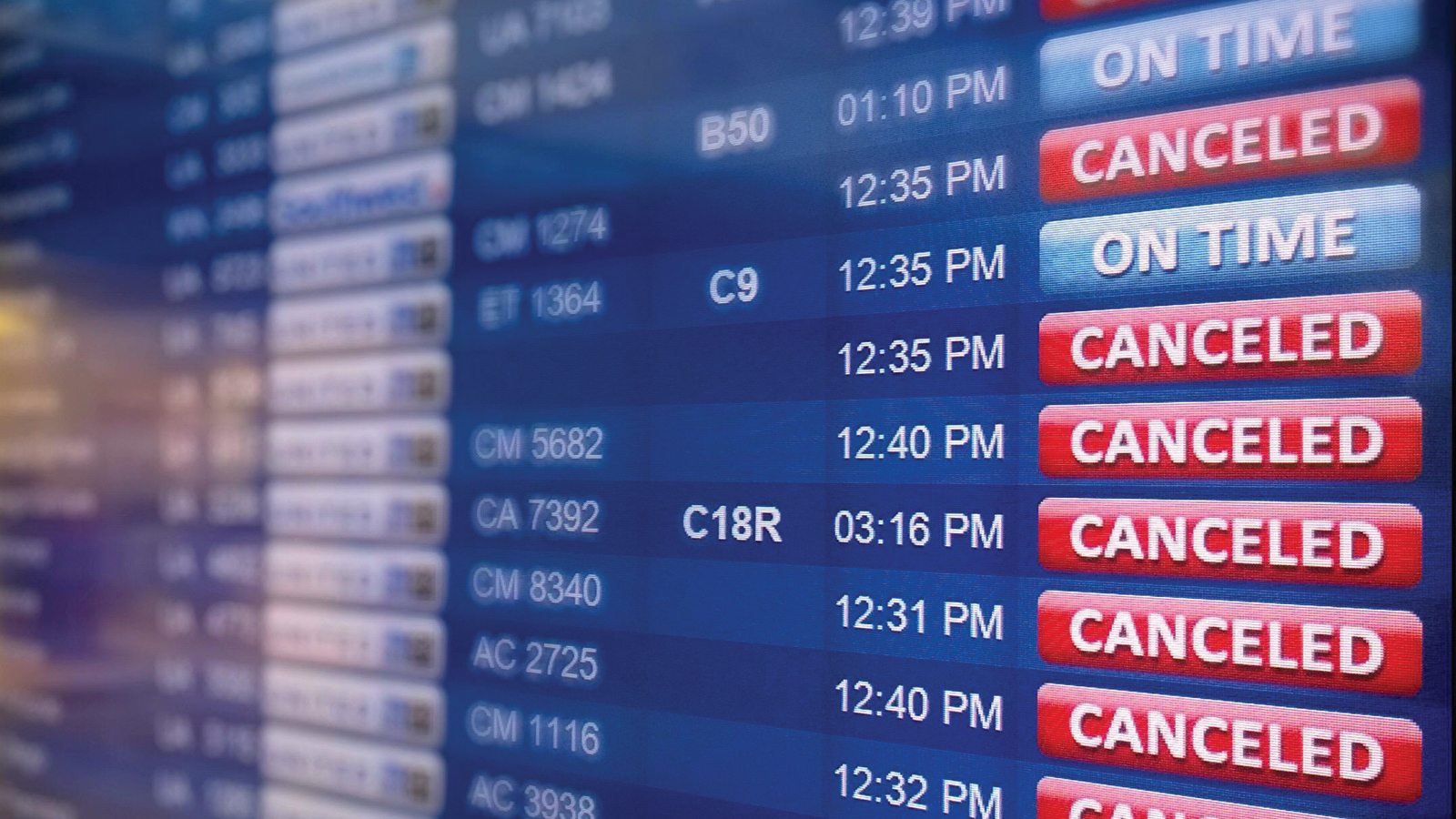

Cruise insurance can offer financial support for many unexpected problems you might experience with a cruise. And with a 24-hour travel assistance hotline, you can get knowledgeable help whether you need to find a local pharmacy or coordinate the replacement of lost travel documents such as your passport. While everyone hopes for smooth sailing, the reality is a lot of unexpected issues could pop up on your cruise. Your flight to the cruise port could be delayed, you might get sick or injured on your cruise, or you might have to cancel the whole thing if illness or obligations prevent you from going on your cruise.

Comments

Post a Comment